Banking customer service: A guide

Great banking customer service pays off. Improve customer retention and grow revenue by making it easy for your customers to get fast, personalized support.

What is customer service in banking?

Última actualización el January 26, 2025

Customer service in banking is the support banks provide to existing and potential customers. Banking customers today expect service to be fast, personalized, and consistent–no matter how or when they reach out. Whether a customer is making a call to the contact center or reading your FAQ page, every service interaction impacts their relationship with your bank.

Why is customer service in banking and financial services important?

Good banking and financial customer service is essential to building sticky client relationships, especially during challenging economic times.

In fact, customers are much more likely to churn when they receive unsatisfactory support from their bank. The Zendesk CX Trends Report revealed that 73 percent of financial service consumers will switch to a competitor after multiple bad experiences—and more than half will head for the exits after a single unsatisfactory interaction.

Current challenges for customer service in the financial services industry

The banking crisis has rocked the financial services industrys. With the demise of Silicon Valley Bank on top of rising interest rates and high inflation, customer confidence is low.

This presents an opportunity for banks to modernize their support offerings and deliver a seamless service experience wherever customers are. Additionally, banks must continue to adhere to the most advanced security measures with customer data, while also providing the kinds of hyper-personalized interactions today’s customers expect and are accustomed to receiving from their favorite brands.

Best practices to improve customer service in banking and financial services

- Use AI

- Personalize service

- Connect experiences across channels and devices

- Deliver fast responses

- Deploy an online help center

- Translate data into business insights

- Use workflows and routing

Provide more proactive support

1. Use AI to scale productivity and reduce costs

AI and automation allow firms to scale productivity while cutting costs, free-up customer service reps on routine tasks, and assist customers with common inquiries so agents can focus on impactful human interactions.

For example, a chatbot can answer FAQs or collect key customer information upfront while automations can alert agents to tickets that remain unresolved and need to be escalated.

Take Coda Payments’ chatbot, which provides customers with the choice of interaction style that suits their personal preferences and type of query–whether that is having a complex issue resolved by speaking to a real-life agent or getting instant assistance with simpler queries from the bot. Agents are benefitting too: with fewer spam tickets and a decreased workload, they can spend more time providing quality service to customers.

“Before, about 60 percent of our tickets used to be blank or spam,” said Bharati Amarnani, Global Customer Support Director at Coda Payments “Now, that number has been reduced to 20 percent because the bot can help solve basic queries and filter out blank tickets before directing customers to a human agent.”

2. Arm associates with data to offer personalized service

According to the Zendesk CX Trends Report, 59 percent of financial services consumers believe businesses should use the data they collect about them to personalize their experiences, while 77 percent of financial services business leaders say deeper personalization leads to increased customer retention.

Banks must integrate data across business systems–from admin tools and CRMs to data warehouses and everywhere in between–for a complete view of each client’s details. A 360-degree customer view ensures representatives can access key context, like product usage, communication preferences, and lifetime value, to personalize conversations and drive upsells and cross-sells.

3. Deliver a connected experience across channels and devices

The Zendesk Trends Report also found that 66 percent of financial services customers want help that doesn’t interrupt their current task, and 64 percent spend more when issues get resolved where they already are. Yet many banks don’t offer a clear support path across their digital channels.

Embedding support across channels and devices is one of the first steps to providing the consistent and connected experiences customers expect. For example, Coda Payments uses a unified agent interface to manage customer interactions across email, Facebook Messenger, live chat, Instagram, WhatsApp for Business, and LINE.

“With one unified platform on Zendesk, we can respond across multiple channels in one place, which is especially helpful when customers repeat a query on different channels,” said Bharati Amarnani, global customer support director at Coda Payments. “Ultimately, we want to be there as a brand to support our users. Our customers appreciate the ability to reach us via these different channels.”

4. Deliver fast responses to improve the speed-to-close of offerings

Responding to client inquiries with speed and agility is a high priority when handling financial transactions. Many banking consumers prefer to speak to a representative before making higher-stakes financial decisions—for example, when taking out a loan. Fast responses increase the speed-to-close of offerings, which has a direct impact on your bank’s bottom line.

Increasing the speed of responses requires having all customer information located in a single place, said Ben Chapman, Director of Client-Facing Experience and Analytics at Homebridge. That visibility helps the support team improve its rate of getting loans closed. Being able to reduce how long customers have to wait for mortgage approval also helps set the company apart from other lenders.

5. Deploy an online help center to deflect common questions and help clients navigate the financial world

A robust help center or self-service client portal can help deflect tickets for agents while ensuring customers have quick, 24/7 access to helpful information and answers. It can also be a great tool during customer onboarding to help clients learn how to derive the most value out of your products and services and navigate the financial world.

For example, Neo Financial designs self-service videos for customers which are posted in the help center and on YouTube, covering basic education and FAQs–Think: “How do I activate my card?” “How do I pay my bill?”

LendingClub is another financial services company investing in self-service. The team uses article ratings to ensure that help center content is meeting customer needs. The team also regularly updates content and pays careful attention to what search terms customers are using. As a result of this dedicated investment in content, LendingClub has established a self-service score of 11:1, meaning for every 11 visitors to the help center, only 1 ends up creating a ticket.

6. Translate client data into intelligent business insights

“Allowing customers to get the right answer on their own is very important. We’ve invested a lot in making sure that we offer a robust help center, and we’re constantly revising it,” said Andrew Jensen, Director, Payment Solutions at LendingClub.

When service teams have access to the right data, they can act as a feedback loop for business innovation and improvement.

Take it from Siemens Financial Services. With all its customer data living in one place, the team can easily analyze and create reports on ticketing spikes, which has allowed the executive team to make better data-informed decisions on how to respond in the future.

“Over the years, we’ve become a source of feedback for the rest of the business in terms of what our customers want, trends in the marketplace, and really key innovations,” said Steven Franklin, Global Head of Customer Service at Siemens.

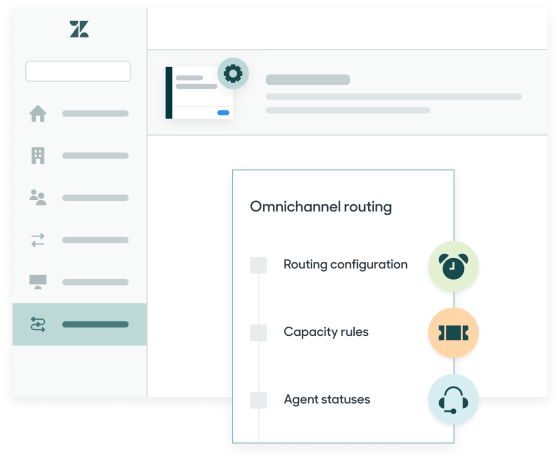

7. Use workflows and routing to prioritize high-tier clients

Workflows and routing can help support teams work more efficiently and deliver more seamless support at scale. With the right customer service software, banks can route tickets by agent status, capacity, skills, and conversation priority.

With Zendesk, tickets can also be routed by account sentiment, intent, and language. That way, agents can help higher-tier clients, clients at risk of churning, or those facing more urgent issues right away.

8. Provide more proactive support

A Forrester Consulting survey of over 2,000 banking consumers and over 100 lending strategy leaders found that half of all respondents wished their bank took a more proactive approach to deliver relevant information and advice about their financial well-being. By integrating systems across the customer experience, banks can provide proactive advice and support at scale.

Take Homebridge. Proactive chats initiated by agents help to decrease the bounce rate of site visitors. The customer service team reaches out to visitors and asks them to fill out a simple form. In this way, agents are garnering valuable sales leads and helping accelerate the loans process.

Examples of excellent customer service in banking and financial services

Deliver top-notch banking customer service with these examples of good support from real financial services.

Starling Bank provides exceptional 365/24/7 customer service

Starling Bank, a British neo bank, runs a 365/24/7 contact center across various digital channels so customers can get help at any time, day or night. To streamline support, every agent has the skill to respond to any contact method. This makes it easy for people to get guidance managing their wealth where and when they want to.

Zendesk for banking customer service

Whether you’re a well-established bank or a high-growth startup, Zendesk can help your team deliver seamless and personalized support at scale.

With Zendesk, all of your client data can be accessed from one place, so your team can give tailored advice and answer questions faster–with the highest standard of data security. Teams can also leverage automations, self-service, and AI to deflect questions while also gathering information that directs clients to the right representative.

Explore more industry solutions

See how a service-first solution can take your customers from initial sale to strong long-term relationships with solutions designed to meet your industry’s unique needs.

Invest in customer relationships

Join other financial institutions using Zendesk to build customer relationships that last. See how Zendesk fits your needs.